I’m sure you’ve heard the old saying, “money can’t buy happiness”. Well, maybe not, but if you manage it right, your life will be better for it. One of the greatest skills you can teach your child is financial literacy. From a very young age, teach your kids about money, how to save, spend, and invest it.

This post is sponsored by Apologia World. I was compensated for my time and honest review of this product and/or website. As always, all opinions are my own.

Teaching Kids About Money

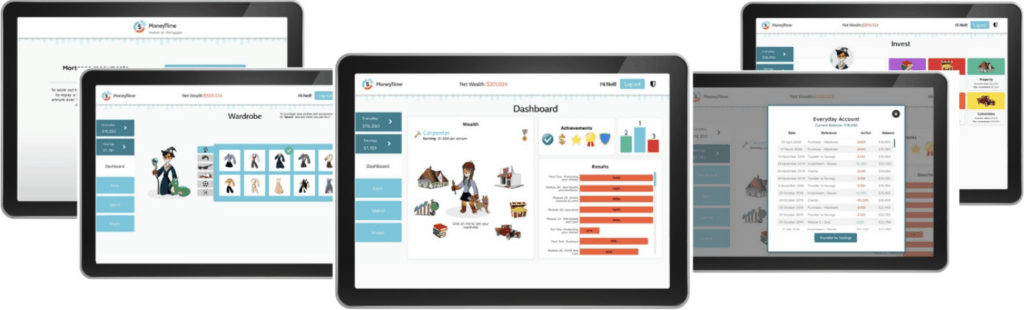

In this digital world, it is more important than ever that your children learn the ends and outs of how money works. And I’m not just talking about snack money. It’s never to early to teach your children about online banking and credit/debit cards. While many of the programs that you may find are boring and geared towards older kids, I am thrilled to share with you the MoneyTime Financial Literacy Program. MoneyTime helps parents teach about financial literacy in a fun and exciting way.

What is MoneyTime?

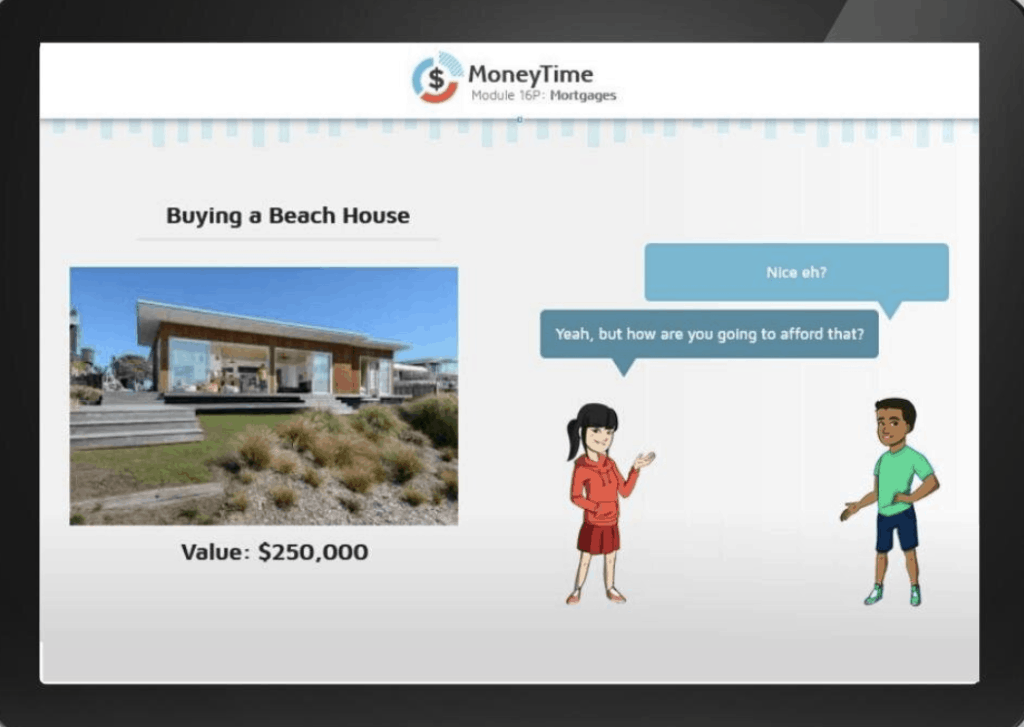

You could spend hours scouring the internet for the best course on investing for kids or I could just tell you right now to head on over to the MoneyTime website and save you a whole heap of time and trouble. MoneyTime offers an online program that not only teaches kids about earning and saving money but also about investing, business and so much more! With over 40 modules, kids will learn so much and have fun doing it.

Let me tell you why I love MoneyTime for Homeschool…

Variety of Skills

When the student starts working within the program they will be met with over 40 modules covering 30 financial literacy skills that they can use in real life situations.

It’s Flexible:

Kids can complete a module in about 15-20 minutes. This is something that can be done daily or weekly. You can make it work with your personal homeschool schedule. MoneyTime does not take up a whole lot of time and did I mention it was basically independent work!! That’s right! Your child can work on this program while you are doing something else. Helping another child, putting on a load of laundry or enjoying a cup of coffee.

Ease of Program:

A program that is hard to navigate can be a nightmare for both parents and children. I was amazed by how easy MoneyTime was to work with. The helpful characters and games make this program one that your kids will be asking to “play” and all the while learning life skills.

MoneyTime has three family subscription packages – 1 child, 2 children, and 3-5 children. Contact [email protected] for subscriptions of more than 5 children. They are happy to work with homeschoolers! MoneyTime also offers a 60-day money-back guarantee. So you can try MoneyTime completely risk-free! What have you got to lose? Order and get a 25% discount by using the coupon code HSCHOOL20 at checkout. This discount applies to single and family subscriptions. Sign up for the MoneyTime newsletter to receive resources on how to teach your child about money.

Win 1 of 10 MoneyTime Financial Literacy Programs for children ages 10 to 14